Two months into 2017, two noteworthy acquisitions and one large capital infusion on a land acquisition and development venture in Texas are just hints of a lot of activity we’re hearing about on the deal-flow front. Sounds like things are only just getting warmed up, and that this 12-month period could go down as one of home building M&A’s banner years.

Let’s take a look at why that is.

National Association of Home Builders chief economist Robert Dietz’s latest take on acquisition, development, and construction lending to builders offers a good entry-point in the discussion.

Dietz points out that AD&C lending, the lifeblood of capital to private home builders, has continued to grow, 15 quarters running, through the 4th Quarter of 2016. FDIC-insured institutions upped their ante by $1.2 billion in construction lending activity in Q4 2016, pushing the total value of the stock of loans close to $70 billion. That’s 71% growth over the same benchmark lending levels in 2013, an increase of nearly $30 billion.

Thing is, Dietz observes, year-on-year rate of growth in such loans is slowing, well shy (by 66%) of peak AD&C lending levels of north of $200 billion in Q1 2008. The other thing is, that for other than vertical construction finance, it’s still just plain hard for many private builders to get capital loans they need to buy and develop a lot pipeline they need to move their business horizons more than 12 months out. Dietz writes:

“Despite the steady increases in residential AD&C lending, there exists a lending gap between home building demand and available credit. This lending gap is being made up with other sources of capital, including equity, investments from non-FDIC insured institutions and lending from other private sources, which may in some cases offer less favorable terms for home builders than traditional AD&C loans.

So, here you have one of the strong motivators for sellers in the M&A equation, exacerbated by scarcity-driven high lot costs. Private home building firms that operate in the locales where big publics troll for land deals have it especially hard, because they can’t match dollar for dollar on a land parcel, so they need to counter-program by zeroing in on more complex, smaller, off-the-radar lot opportunities.

Two kinds of leaderships among private home building companies are ripe for deals. One is the 50- to 60s-year-old multi-cycle founder or founder’s next generation principal who wants a gracious, smoothly transitioned exit plan put into place. The Sumitomo Forestry deals with Bloomfield, Dan Ryan Builders, Gehan, and, most recently, Utah-based Edge Homes are good illustrations of that kind of motivation for a seller. The other private home building company leadership type motivated to sell is more likely to be a younger, harder-charging entrepreneurial principal or team, hungry for opportunity to take what’s been a good thing during the first part of housing’s recovery to another level.

Consider Wade Jurney’s venture with Century Communities, where Century’s 50% equity position in the Raleigh-based juggernaut might be considered rocket fuel for the Jurney organization to continue on its explosive trajectory. That would have been difficult, competing in markets increasingly crowded by behemoth public companies looking hungrily to feed their regional growth machines.

So, that’s a bit on what’s behind the pep among potential sellers. They have to be thinking, “is the land asset value and my exclusive ability to deepen a potential buyer’s local scale–for access to lots, trades, and home buyer customers likely to be the same, lower, or higher this time next year?”

That’s an important question to answer, because it serves as part of a calculation on how much AD&C capital they’ll need, and the exposure that entails when other conditions continue to play out.

Acquiring company motivations, on the other hand, have become fascinating, and for simplicity’s sake, let’s put them in four separate buckets, each bucket with its own set of urgencies, rate of return hurdles, and challenges with respect to integrating a new acquisition target.

- Bucket 1: The classic, big public. These enterprises have urgencies around both growth and sustainable profit, and in a much-more-consolidated landscape, one of the only ways to play out a “more with less” strategy within a current geographical footprint is to acquire then take out cost, gaining the incremental sales volume, local trades clout, and local land knowledge, and sucking out overheads.

- Bucket 2: The “mini-me publics”. Companies that IPO’d in 2012 and 2013 and have cash to burn and manageable leverage but may be looked at with dismay among big institutional investors who wonder, “is that it?” Some of these handful of companies are going to have to make a more expansive destiny manifest, or consider themselves acquisition targets in the pretty near future.

- Bucket 3: Warren Buffett-backed Clayton Homes emerged, somewhat uncannily, as an acquirer of site and stick-built operators. One one level, the deals are like every other M&A transaction in the sector, access-to-lots-focused. On the other, one can only surmise that Clayton’s factory-based pedigree might give its strategic leaders the sense that single-family detached home building may finally be ready for more disruptive, less unproductive construction technologies to kick into play. With its site-built acquisitions, Clayton now has profitable, well-managed operations to serve as living, real-time discovery labs to explore where off-site and on-site construction may converge in a workable iterative model.

- Bucket 4: Japan- and China-based buyers. We’ve written a lot about the raft of deals Sumitomo, Sekisui House, Daiwa House have been involve in, and we know that these organizations, as well as at least three China-based building and development giants have big appetites and lots of resources to bring to the party.

Barclays equity analyst covering the home builder sector writes very clearly and insightfully here on “The Rise of the New Foreign Buyer.” There’s a lot in this report, but one of the kicker conclusions is here.

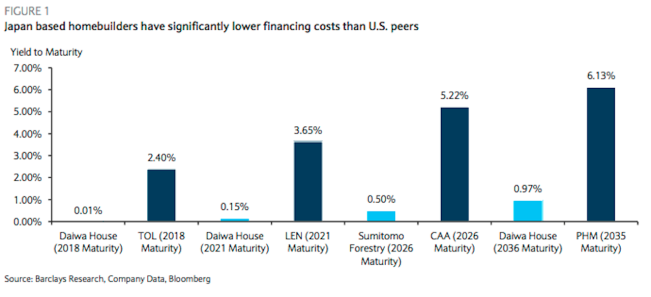

While U.S. public builders often tout their capital advantage over private builders, foreign homebuilders enter the U.S. market with much lower financing costs. All else equal, this advantage would allow an international based builder to pay more for a land deal, while still earning the same or even higher gross margin vs. U.S. peers. For example, the Daiwa House and Sumitomo bonds currently trade at yields 200-500 bps lower than U.S. counterparts depending on maturity.”

What this means is that, for Bucket No. 1 among the acquirers, strategics have a more complicated pathway to getting to what BTIG analyst Carl Reichardt calls “deep local” scale, which he defines as follows.

- “Deep LOCAL share provides 3 advantages: access to trades (which are local), access to dirt (also local) and better spread of divisional fixed costs

- Our analysis shows deep local share is now highly-correlated with ROE (.64 to .79) v. uncorrelated 10 years ago. Being deep in a few markets is a better path to returns than being shallow in lots of markets”

So, while it continues to be tough for private home builders to access acquisition, development, and construction lending, housing consolidation moves are stacking up to provide a dramatic year ahead.