Sometimes we take for granted how households work in the economy.

Together, U.S. households, and what they spend money on, account for two of every three of the economy’s GDP dollars.

At a unit level, households reflect basic ways a family gains purchase or traction as family members try to improve their financial wherewithal, options, mobility, and the like. Homes and their proximity to workplaces are one of the clearest illustrations of how households generate and sustain economic viability.

In a post-Great Recession landscape, particularly as the future of work and the soaring cost of healthcare invite such profound questions as they do, households are behaving in a way that shows how important family ties are to economic viability, mobility, options. Jobs and employment wages are still no doubt the most important source of income for our society’s households. But paychecks are not the only financial knobs and levers families press and pull to navigate amid today’s challenges. With past as prologue, households composed of more than one generation of adults may direct us back to the future.

This is why we believe multigenerational living–in its newly-evolved forms and formats–is more than a passing fad, but rather a sneak peek at new strains and streams of household normalcy.

Zillow senior economist Aaron Tarrazas gets at this notion of “entrenched family ties” that mean people stay close to their blood relatives in his recent analysis on “Moving to Opportunity: Why Breaking Family Ties Isn’t So Easy.”

Americans of all ages rely on social networks – family and friends – for assistance with a wide range of basic needs: 33 percent of American households with children rely on extended family for help with childcare, while 17 percent get help from extended family in covering living expenses. And 11 percent turn to extended family for help with eldercare.

In the case of both childcare and eldercare, it is neither the poorest nor the wealthiest Americans who are most reliant on extended family. Rather, households in the fourth quintile – upper middle class households – are most likely to say they rely on extended family for help with childcare (40 percent) and eldercare (14 percent).

This trend declared itself as the housing recovery picked up a little momentum a few years ago. Attainability–a nicer, more valuable new home that made more sense for two generations of adults than just one–factored into its appeal.

Still, as more Americans, and a greater percentage of them age, that appeal grows. This is the impetus for the discovery process that underlies our BUILDER Concept Home program this year, the Meritage reNEWable Living Home, which makes state-of-the-art sustainability technologies, and flexible, adaptable floor plan configurations attainable to the folks who opt for multigenerational households.

We’re going to take you inside our consumer research process and pour out the insights–each of which has strong implications for design, engineering, systems, envelope, and livability components in homes built to accommodate more than one adult generation under one roof.

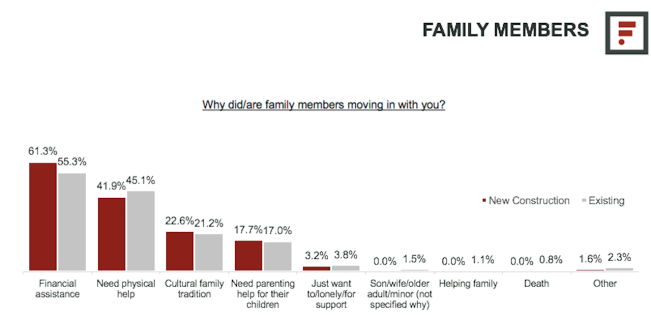

For now, we’ll reveal a sneak peak at the data that spotlights what folks say are the most important reasons why they’re choosing multigenerational households, and it ties to what Aaron Terrazas observes in Zillow data about families that stay put and why.

With our partners at Farnsworth Group research, we’ve teamed up with Meritage Homes to help quantify and understand one of housing’s unmet needs–namely how big the multigenerational household population is, diving into specifics of household composition, and the preferences that those households have in terms of features, functionality, performance, and housing finance.

Here’s two top line data points from the study for you to consider.

The most important reason primary homeowners say they seek multigenerational features and functionality in their homes is for financial assistance, meaning having more than one generation living under one roof makes a difference in the attainability of the home. A fairly close second ranked reason (42%) is physical health, which ties to the first insight, given that aging parents frequently have current or future health issues to deal with.

We’re guessing that the underlying financial factors that motivate families to want to stay in near proximity to one another are only strengthening as challenges surface around automation, robotics, data, and the future of work.

The multigenerational living trend is only now getting a start. Stay tuned.