Demographics may not be destiny–as it’s previously been rumored to be–but it sure is helpful when it points a business in the right direction.

We figure that the “noise” of this week’s news cycle Trump Card from the White House–a one-page tax framework that proposes radical cuts for businesses and individuals, but leaves many guessing as to how revenues for Uncle Sam’s ever-more-needy coffers get generated–has people in housing in a full-on tizzy.

So, why focus on the “noise?” The President’s tax proposal fulfills a campaign promise, and puts his chips on the table. What will happen next, and after that, and after that, and so on, will be that those chips will move this way and that way, and very likely some of them may be on different parts of the table at the end of a process, whether it’s contentious, productive, bi-partisan, combative, compromising, or whatever.

The “noise” is a flurry of distracting speculation on the verbiage and terms of a deal that is essentially the start of a negotiation process from a highly experienced deal-maker.

The “signal” is where we’ll focus our attention instead.

There are economic challenges, business risks, and complexities galore for home building and residential community leaders to concentrate on and solve for, not to mention, day to day operational details that need vigilance, deft handling, and nimbleness in order to achieve the constant state of improvement essential for firms of any size to thrive.

The tax plan, for what it is, is not really a plan, but a sketch of a broad goals based on economic theories about how to stimulate faster, steeper, more expansive growth. Almost anybody can agree, growth above anemic 1-to-2% levels of the past several years would be great. At what cost, though?

At any rate, goings on on Capitol Hill over the next stretch of the foreseeable weeks and months will be all about noise–continuing resolutions, a spending for the balance of 2017, a 2018 budget, tax reform, health care, etc.

What a good time for builders to focus instead on the signal rather than the noise. Operational excellence. Disciplines. Customer care. Building your team’s culture. Pacing investment where and when real opportunities emerge vs. flinging money blindly anywhere and everywhere.

And, by the way, taking the pulse of real demand, demand that is and will be consequential to where those investments need to be and when they need to happen might be a more fruitful signal to concentrate on, rather than getting wrapped around the axle of early-stage political wrangling over changes in tax rates, deductions, and allowances.

So, why not check out this fascinating dive into new evidence that young adult 30-somethings may be about to shift from “pent-up demand” limbo to pure demand status, albeit a few years later on par than prior generations?

Analysts at Zelman & Associates bring an as yet barely-tapped data base to their hunch that the secular and cyclical factors that have been holding up family formation and births may be on the verge of a fast, dramatic surge in both. The Z Report’s latest series of trend spotlights includes one that notes:

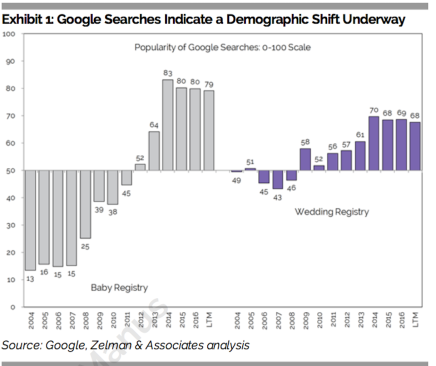

“Our new analysis of Google internet searches indicates that the cyclical factors that negatively affected marriage and birth rates are rapidly fading. If this is a true indication of consumer behavior, it would be an incremental demographic tailwind for single-family living.”

Don’t know about you, but to us, that beats what’s happening between the White House and the Hill right now for material impact on residential development investment, new product development, land strategy, 2018 and 2019 budget modeling, etc.

Zelman’s probe into Google search data is akin to health experts tracking Twitter to pick up first signs of a new flu season, a phenomenon that has reliably identified where outbreaks originate. Zelman notes:

“To gauge pending marriages and births, we compared popularity of searches for wedding and baby registries. Interestingly, the index for both measures has increased substantially over the last three years. For example, in 2016, the index averaged 69 for wedding registries and 80 for baby registries, similar to 2014 and 2015 near the high end of the annual figures. For comparison, these indices averaged 53 and 37, respectively, from 2008-11. This relative improvement is a very important signal from our perspective.”

We recall JP Morgan chief economist Anthony Chan once revealing a proprietary measure he became confident as an indicator of an imminent end to an economic downturn. Women’s shoe sales. Reliably, a surge in spending on this specific purchase would serve as an inflection point in consumer household discretionary spending.

Zelman’s look at wedding and baby registry searches on Google may emerge as an equivalent tipping point indicator, new evidence that young adults may be heading toward demographic destiny in more ways than many would have presumed a few years ago. Homeownership rates may be in for a slow turn upward over the next several years as pent-up demand becomes demand.

The Z Report is a twice-monthly package of original, exclusive data and analysis from the team at Zelman & Associates. You can try it out for free by linking here.