The United States’ global, geo-political situation got exponentially more complicated, literally overnight. Today, which might have been another “Jobs Friday” in a series of progress points dating back between 24 and 36 months, is, instead, something else.

Housing’s peppy Spring 2017 selling season has built a solid foundation underneath it. We’ve been hearing from everybody we’ve been talking to, “we’re ‘good’ busy.” The new communities are opening. The ready-to-move-in homes are moving; and the orders are picking up pretty much everywhere, as the economy and jobs keep showing strength, and confidence rises among businesses and people that tax and regulatory burdens on their resources will find some reprieve in the months and years ahead.

We heard from David Rice, founder of Chicago-based New Home Star, a corps of 250 sales agents selling for new home builders in 22 markets nationally, that March was a 500-home sales month, the team’s highest on record by more than 20%.

“The big public guys are turning in impressive numbers,” says Rice. “And it’s neat to see the private guys getting their share too. ”

It helps that still-low interest rates and upward-spiraling rents have converged in a final leg of relative affordability with a pent-up surge in homeownership that finally recognizes itself as pent-up, and not forever shut out of the opportunity to own.

One of the mysteries of the recovery thus far has been how it might feel and act if it fired on all cylinders, rather than limiting itself to mostly discretionary buyers with greater wherewithal as the prime movers during the first three or four years of it.

Now, it seems, that mystery is close to being solved, as young adults wake up to a “manifest destiny”–a lighter student debt burden, a better job, a mate with a good job, and a family narrative to create–and start to find new home communities cropping up here and there, specially priced and designed with their needs in mind.

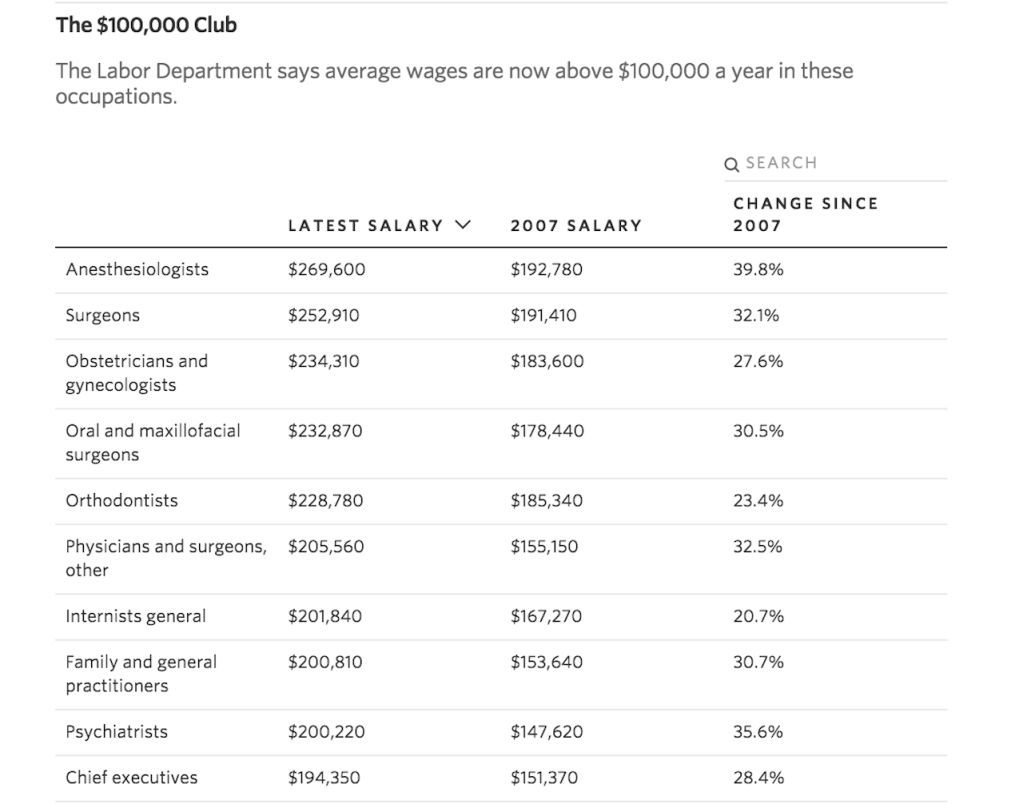

On the jobs front, young people with solid educational backgrounds are making progress in their career pursuits. Here, Wall Street Journal economics writer Josh Zumbrun takes a look at data from the Department of Labor’s Occupational Employment Statistics program, focusing on the 75 or so job occupations whose annual salaries tend to exceed the six-figure $100,000 mark. Zumbrun writes

The statistics underscore some of the complexity of U.S. income inequality. Adjusted for inflation, the median household income is below its level of a decade ago, a statistic that became a rallying cry for many supporters of President Donald Trump and Sen. Bernie Sanders. At the very top, U.S. incomes have soared away from those of the middle class. As of 2015, the top 1% of earners had a minimum income of nearly $443,000 a year, according to data from Emmanuel Saez, the U.C. Berkeley economist who has worked with Thomas Piketty to measure the extremities of U.S. income inequality. Yet the new Occupational Employment Statistics provide a window into the types of careers that would typically be described as upper-middle class.

Here’s an analysis from GoBankingRates.com, comparing the cost-of-living of the 50 most populous U.S. cities based on the median income by city and the dollar amounts required to cover the cost of necessities, including rent, groceries, utilities, transportation and healthcare in each city.

The questions of the morning are, will jobs growth in March continue both the headcount and household income growth momentum they’ve show lately in the series? And two, will the emergence of new U.S. military initiatives in Syria cast a pall on what has thus far been a vibrant Spring Selling Season for U.S. housing?