Innovation comes from all different avenues and, sometimes, from completely different industries. With housing representing such a large asset class, it’s no wonder that other industries are trying to make their way in. Many study how their products could be adapted or revised to make sense for housing, but some fall into it accidentally, creating a completely disruptive product and celebrating a new world of success.

Best Practices

Tesla started out with a focus on luxury electrical vehicles. Yet its founder, Elon Musk, constantly looks for innovative ways to develop products that use clean electricity for American consumers. Through a decade of innovation in car batteries, housing now benefits from the Powerwall, a wall-mounted, residential, rechargeable lithium-ion battery powered by solar energy. It’s integrated into the local grid and it harnesses solar energy during the day to make it available for use when the sun is not shining.

Meanwhile, Phillip Winter, founder of Nebia, designed a wall-mounted showerhead with the same software used for aeronautic research and powering jet engines. The technology atomizes water into millions of droplets, creating 10 times more surface area than a regular showerhead. By splicing the water molecules and dispersing them in a more efficient way, the Nebia shower saves 70% of water with its 0.75 gallon per minute (gpm) flow, making it more environmentally friendly than a standard showerhead and providing savings on utilities.

Another approach to bringing innovation to housing is to be inspired by nature. Ginger Krieg Dosier, founder and CEO at BioMASON, wanted to apply the same low energy, low material input that makes coral into building materials. She wanted to remake this slow, natural process to create customizable bricks that not only perform better than traditional bricks, but also produce no waste during the manufacturing process.

Lahnie Johnson, president and founder of Thermablok, found success in a quest to combat thermal blocking. Through research, Johnson found a polymer material that had the soundproofing qualities of lead without the toxicity and in 1997, he founded Acoustiblok to market it. Thermablok is 100% recyclable, impervious to moisture/mold, and unaffected by age, according to the manufacturer.

A New Entry

Each of the innovations mentioned above had a distinct path to housing. Some manufacturers see the opportunity and then look for a way to seize it. For instance, Hanwha Azdel, a South Korea–based company with three streams of business in manufacturing and construction, finance, and services and leisure, hired a building products professional to help it transition into the housing market. Wade Tennant, business development manager, building materials at Hanwha Azdel, works under the chemical manufacturing and automotive divisions of the company, bringing experience from former positions at CertainTeed and Guardian Industries. Right now, the company has a large share of the automotive headliner business in the U.S., which doesn’t leave it much room to grow. So, the challenge becomes figuring out how to diversify and provide context for future growth.

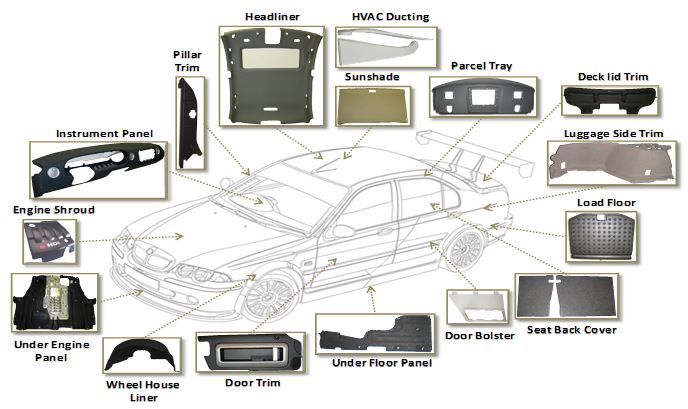

The strategy is to stay close to the company’s base. Its core competency is manufacturing lightweight reinforced thermoplastic in a board format, which is used for headliners that are installed under the fabric in the ceiling of the car. The plastic is an advanced composite with a great strength-to-weight ratio. An obvious entry to housing is to replace resilient sheet materials, like plywood, because the fiber composite is inorganic, impervious to water, and lightweight.

The product design comprises about 40% air in the core matrix, which can be varied, but allows it to be super lightweight while still maintaining the same tensile strength. The presence of the air also gives it the ability to absorb sound well. So when it comes down to a noise reduction coefficient, it performs really well. For instance, a multifamily property would need a lot less of this new product to absorb sound than high-density fiberglass. As an additional bonus, the new product is formaldehyde free, giving it sustainable credits.

Market Approach

The housing market operates differently than the automotive industry. In the automotive tiers, there is much less marketing involved, and it is generally spec driven, Tennant says. However, for products to be used for housing, it will require a new and different approach.

Hanwha Azdel

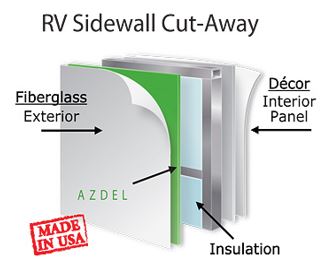

Hanwha Azdel considers the RV wall to be similar to how to build SIPs.

“The biggest challenge is figuring out where and what we want to be,” Tennant says. “For housing, they immediately asked us for things that we weren’t doing, like can we sell our product on a roll? Another challenge is to understand the complexities of turnkey industries that are different than automotive.”

Tennant is spending a lot of time studying the requirements to get into housing—he’s digging into market intelligence, attributes, code requirements, and building relationships, which he says is a challenge coming from a different industry.

Operationally, big changes will need to take place to align the business with the needs of manufacturing a new product line at a high volume.

“We don’t offer a product off the shelf today,” Tennant says. “We would need to change mentality and work ethic.”

The Future

Next, Tennant says the company is working on producing structural insulated panels (SIPs) that may provide a potential replacement for wood-based substrates. But first the housing industry has to start using SIPs at a higher volume.

Right now, Tennant estimates that homeownership is roughly five to seven years, and there is a 10-year timeline to financially justify building with SIPs, so the gap needs to be managed before it’s a viable product.

Hanwha Azdel is one example of product innovation that’s tapping into the housing industry. Come discuss more at the HIVE conference, Dec. 6 to 7 in Los Angeles.

This article appears as it was originally published on BUILDER’s sister site, www.hiveforhousing.com.