BUILDERS HAVE LONG UNDERSTOOD that cabinetry can make or break a kitchen. This seems fairly obvious, given that cabinets are the dominant feature in the most important room of the house. But if there was any doubt, an independent model home study commissioned by Merillat last year confirms that notion. When roughly 200 people were asked which feature they cared most about in a new kitchen, cabinetry ranked No. 1. What’s more, it may actually nudge the home sale in the right direction. Only 3 percent of the shoppers said they’d consider purchasing the house if they didn’t like the kitchen.

A well-merchandized model kitchen can clinch the deal while offering buyers a preview of the upgrades. The research showed, however, that cabinetry often translates into missed opportunities to educate shoppers. Jim Potthast, Merillat’s communications manager, says that people walk though homes with their hands in their pockets, as though they were in a museum. There has to be a point of discovery—a simple tag that says “open me” or “look inside.”

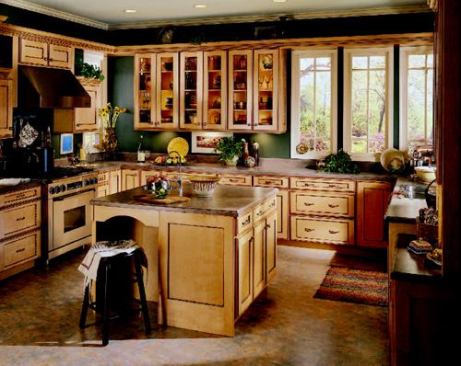

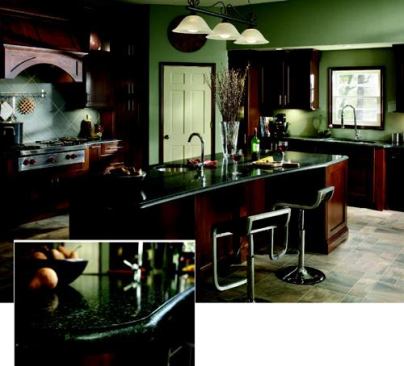

WARM AND CASUAL Jan Roberts, director of the design center and merchandizing for Lombard, Ill.-based Town & Country Homes, tracks the cabinetry features that are selling well in the design center and then promotes them in the model homes. “It really does boost upgrade sales,” she says. About 70 percent of the builder’s predominantly entry-level and move-up buyers switch out their standard oak cabinets for cherry, ash, and maple. And Roberts says customers routinely choose cherry cabinets, spending an extra 15 percent for chocolate-colored glazing and then pairing the cabinets with richly colored countertops.

With 1,100 house closings a year, Town & Country streamlines its options program through a series of well-priced packages. It’s the kind of high-volume builder that Dallas-based Quality Cabinets targets with its entry-level WoodStar line. Marketing director Tim Shaw says two new door styles introduced last year have been strong sellers. Builders are showing the flat panel Seacrest door in oak or birch as standard, and the raised panel Harborview as an upgrade. Quality Cabinets packages popular upgrades for builders in the move-up market, too, typically in 20 percent price increments ranging from glass door options to full wood drawers with dovetail joints to decorative accents such as corbels and crown molding. “We’ve seen the trend toward full wood drawers up tremendously,” Shaw says.

SURFACE APPEAL Countertops, which typically play a supporting role to cabinetry, have become show-stoppers in their own right. Because granite is more affordable than solid surface materials in the South, Hedgewood Properties specs polished granite countertops even in its lowest-tier homes, which start at $300,000. The design center recently expanded its standard granite options from five to 10, and about half of Bryant’s customers choose upgrades. Among the offerings: more expensive granites with honed and brushed finishes; marbles; limestone; solid surfacing; quartz; and fancy edge details. The builder won’t say no to edgier materials, though they’re not on display. “People can order concrete counters on request, and we have some samples of slate and soapstone,” Bryant says. “But we’re not trying to sell them, because they’re riskier to work with.”

In the past five years, the price for stone has come down, allowing production builders to offer it across more market segments. James Babineaux, director of new construction for Silestone by Cosantino in Houston, says the downside is that builders have had trouble finding fabricators and installers who can keep pace with their building cycles. With its coast-to-coast production network, he says, Silestone can deliver its quartz products within one to two weeks. But color drives the price upgrades. “The trend we’re seeing is that builders don’t want a lot of colors,” Babineaux says, adding that the company has just signed on with the virtual design center, Envision. “We’re segmenting our offerings into three or four color levels. Builders are saying, ‘Just give me 12 and keep it simple.’ ” With its new River series featuring fluid, non-directional veins, Silestone will soon add four colors to the 48 it already markets.

Jim Wielinga, residential marketing segment manager, says even entry-level laminates are taking on a new refinement with the use of digitized printing and etching. Last month, Formica reintroduced the iconic boomerang pattern—a combination of freshness and nostalgia that appeals to boomers and Gen Xers alike. Paired with some cool cabinetry on an island, it may provide just the right back-to-the-future aesthetic that packs an emotional punch.

It’s just one example of a memorable option that builders might offer to set themselves apart from the competition.