Let’s take a look at some numbers. The equipment rental industry is a $40 billion to $50 billion business annually, and that business meets 98% of rental demand today, according to Willy Schlacks, president of EquipmentShare.

Many would be discouraged by those numbers, thinking there was just 2% remaining for a business opportunity. However, Schlacks saw an opportunity. The numbers came together in a way that gave him tunnel vision staring at a niche service that would provide a huge benefit to potential contractor clients. He is betting that 20% of the rental business could be met by contractor supply to make the whole industry more efficient and less wasteful.

Today there is a lot of equipment being rented, as Schlacks stated, adding up to more than $40 billion annually. This includes aerial and land-based equipment. Land-based equipment can be further divided into vehicles that can be used on a day-to-day basis and heavy equipment. The equipment also could have day-to-day use or be used only on a specialized project basis. All of it equates to a large bottom line for a contractor. Contractors invest large dollar amounts in equipment and sometimes their cash flow gets locked up in these investments.

Items that are needed on a project basis are not big winners for a contractor. Because, like other equipment, they are a large investment and although they may have high utilization for a specific project, afterward they become dust collectors, averaging a very low utilization rate.

The model that Schlacks created helps contractors purchase that equipment, at a much lower overall cost than renting, and then rent it out for an even better return on investment and reduced cost of ownership. With the rent in the consideration set, the utilization is higher and makes owning the equipment affordable.

Schlacks admits that this is not a friendly model to the rental companies. But selling this to contractors has been easy—they realize the profits and can integrate them into their business to be more efficient and nimble, even to the point of taking additional risks to grow their business.

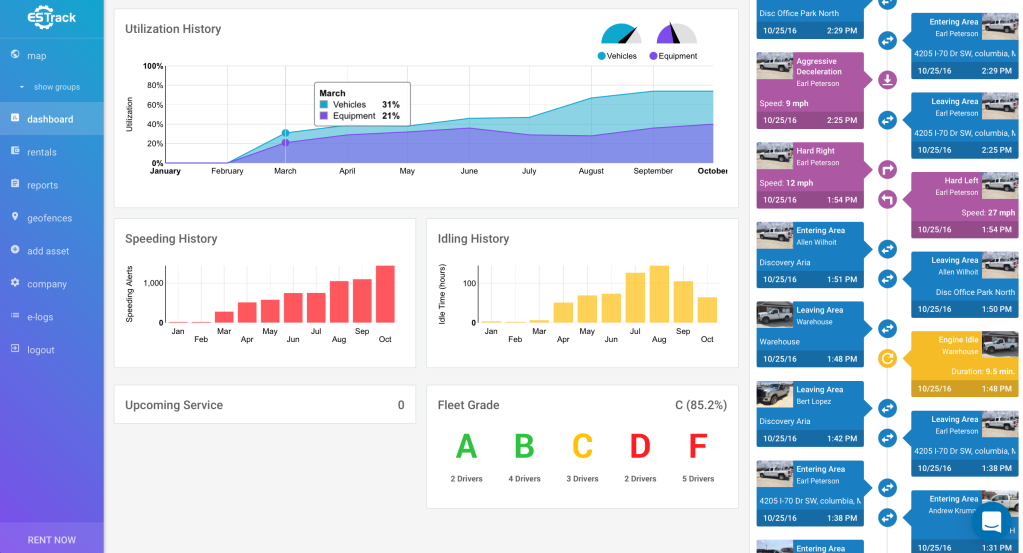

That’s how EquipmentShare got started. It offers the service of analyzing data. That data goes deep, as Schlacks describes it. It gets aggregate data that many fleets with similar capabilities haven’t been able to achieve because they have multiple brands of equipment and vehicles on the jobsite. With EquipmentShare, all the data across the entire fleet is aggregated into one window, or dashboard view, for the contractor to have access to on demand.

EquipmentShare

Aggregate data for all units in the fleet is critical.

The data includes telematics acquired from hardware that is installed directly on each piece of equipment to extract data. EquipmentShare analyzes fuel levels, coolant temperatures, machine hours, usage, oil levels, along with dozens of other data points. Then it delivers reports. Schlacks explains that utilization should be greater than 70% for vehicles and at more than 30% for equipment.

EquipmentShare

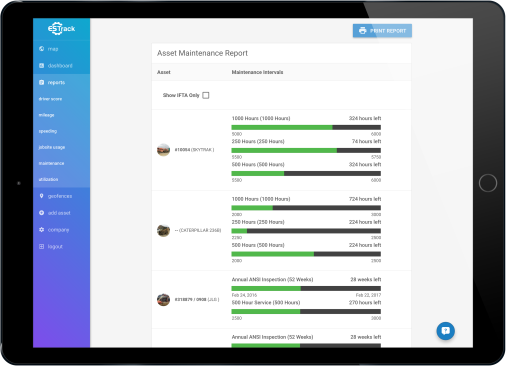

Dissecting data minimizes down time from maintenance.

If the utilization is low, they start examining why. It could be maintenance or that the contractor actually owns too many of one piece of equipment. It takes months to collect and have reliable data to share, but it eventually leads to understanding what assets are overhead and should be rented out.

“Renting equipment is the most expensive way to acquire equipment for a jobsite,” Schlacks explains. “Owning it is the least expensive. You should always rent some and you should always own some. It’s about achieving a balance, but you need that data to understand the balance.”

Schlacks explains with an example: Imagine a contractor has a piece of equipment that lists at $130,000. And, he sees that there is an average 90% utilization of that asset in that market, so the equipment is in demand. When the contractor isn’t using it, he can tap into that demand and rent it to another contractor, increasing his cash flow and the utilization rates for that item and essentially flipping the asset on its head.

Ben Brubacher, CEO, Brubacher Construction, and EquipmentShare customer has seen the data come to life with his company. A rookie with telematics, the data that he was able to acquire is now helping him rent out 12 pieces on average of his 20-unit fleet. No doubt it will have an impact on his bottom line at year end. Currently he’s seen that it helps them keep job costing where it should be.

Brubacher also sees the future benefits of the data. He looks forward to the day when they have access to historical data that will allow them to intercept preventative maintenance issues and therefore eliminate down time in the EquipmentShare circle.

Specialty equipment, like cranes and other aerial items, usually have very low contractor ownership rates. This business model allows them to leverage other use within the market and increase utilization of their purchase.

The numbers tell another story to Schlacks. As he explains, the access to the utilization data could equate to huge insurance cost savings as well.

“For instance, if a contractor has $1 million of assets, and two years later the insurance company uses their formulas to say that the assets have depreciated and are now worth only half of their original purchase value,” Schlacks explains. “However, with that data and information that EquipmentShare acquires, there would be real time depreciation to tie into the asset and the risk of the asset. This data could reduce insurance costs by 50%. That’s going to be a big opportunity for contractors to increase bottom line and efficiency.”

Brubacher also is anxious to see the benefits in terms of insurance and the level of protection he will have access to through visibility to this data. Plus, he estimates more than 20% savings by being able to leverage with insurance companies for floaters and lending agencies.

As Schlacks has his eye on future opportunities with insurance cost savings, his EquipmentShare model is expanding to 10 markets in 18 months.