Two major mergers and acquisitions deals among building products manufacturers in two weeks. What’s going on? What’s fueling them? What does it mean for builders and what do these deals say about where building is going?

Are the motivations on the buy-side of the deal similar in any way? Are the combinations a by-product of late-cycle maneuvering and business resilience, or are they more about a pan-cyclical, structural new course in the future of work and value streams, materials and product supply chains, scale, and the exponentially important role technology, automation, and data play in building construction operation and economics?

Let’s take a look, why don’t we?

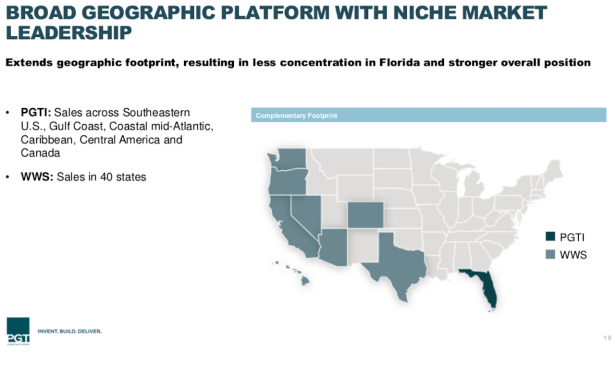

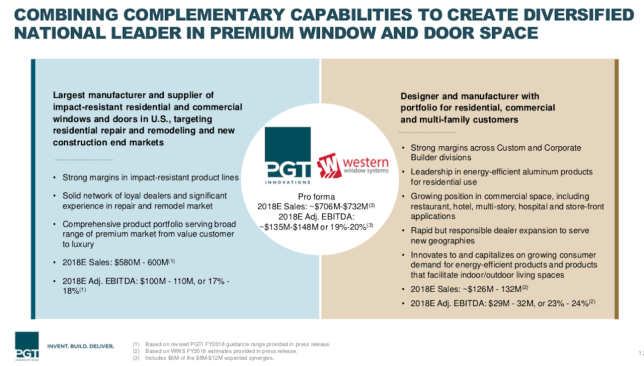

Yesterday, PGT Innovations, a Florida-based maker of high-impact windows announced an agreement to buy Scottsdale, Ariz.-based Western Windows Systems–a designer and manufacturer of contemporary-style energy efficient window and door system–for $360 million in cash.

The deal creates a national footprint and cohesive network of customer, distribution, and selling nodes for windows and door systems that stand out as offering, proprietary, “secret sauce” differentiable values in a highly-commoditized building products category.

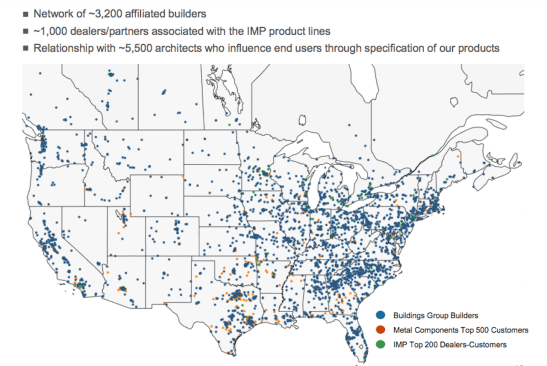

We’ll get to what that means and why it matters in a moment. But first, let’s take note of the other mega transaction, last week’s announcement that Ply Gem and NCI Building Systems, two leaders in structural and exterior building products, will merge in a stock deal to create an enterprise valued at $5.5 billion, with an implied equity value of $2.6 billion, with combined revenues of about $4.5 billion in 2018.

Cary, N.C.-based Ply Gem’s focus is primarily residential exteriors, while Houston-based NCI’s building brands lead in commercial metal wall panel and roofing systems.

The NCI sales and distribution channel.

By comparison with the PGT-Western Windows combination, the blend of a Ply Gem and NCI reflects how players in far more commoditized segments of the building business must find ways to distinguish themselves among their customers and create regenerative growth opportunities. They do it with with speed, with customer-service, with operational excellence, and with innovative manufacturing and distribution systems that cut valuable time and labor costs out of the building economic equation.

For all of the ways the two deals may be different as apples and oranges, here are a few thoughts on why their timing and their strategic model ambitions are worth taking careful note of as the current housing recovery cycle shows more and more signs of a late-stage, at least momentary, loss of conviction.

- The deals reveal a growing focus on vertical construction opportunity. Long-held paradigms that have locked architecture, engineering, and construction into a highly inefficient, overly complex system of resource flows have begun to give way to new, simpler value maps. This mindset gives builders and their investor, developer, and supplier partners new opportunity to zero in on how to rid building–particularly construction of building structures and exteriors–of inefficiency that, in turn, forces builders to rely too heavily on land appreciation trends to cover up for the waste in their operations and processes.

- Secondly, both the PGT/Western Windows deal and the Ply Gem/NCI blend reflect the quantum leap importance of technology and data in procurement and logistics, both from a cost of capital standpoint and a revenue generation perspective. These deals signal that–as buyers of raw materials and subcomponents and as logistics managers of the flow of those materials into products whose value is disproportionately higher than the expense of the parts and processes–scale-ability, clout, and the ability to smooth resource flow across ups and downs in a cycle have emerged as top priorities.

- Third, the deals each, in separate ways, suggest that such combinations need to check a box of a meaningful value proposition and a big idea strategy. In the case of PGT and Western Windows, the underlying grand plan comes from how the products themselves perform in ways that take them beyond commodity. PGT’s products stand apart–especially at a moment where climate disturbance and building codes that aim to deal with it are intensifying on every level–for their exclusive promise of protection and safety. Western Windows, on the other hand, has played a big role in the redefinition of interior square footage, creating valued space indoors and outdoors with energy-efficient, structural connections to living area inside and outside the box. Moreover, the design DNA of Western Windows systems syncs up with the Apple era of contemporary design demand. This deal, at its base, stands for the capacity to expand value within the constraint of a footprint. The Ply Gem/NCI strategic synergy, on the other hand, reflects a more intense focus and impetus toward velocity–which is the combination of speed, precision, and efficiency–as a strategic linchpin to building structures more affordably and, thereby, expanding the market opportunity. Too, culturally, Ply Gem has made service, flexibility, and relationship–with builders, distributors, and trades–a foundation of its business as a point of difference in a commoditized products and materials segment, and in NCI has found a kindred soul on the commercial construction side of things.

- Four, both mega deals shed light on how the construction sector has begun to look at the relationship of investment in factory, automation, robotic infrastructure–with an elevated, ongoing stack of fixed costs for operations–to the builders and developers, who typically contract a multitude of trade players, each with product, materials, distributor relationships on a job-site by job-site basis as a strategic hedge to having fixed costs locked up in a 24-7 factory that needs resources whether the construction cycle is running at peak or trough.

- Five, as we’ve noted before, structural shrinkage in human skilled, semi-skilled, and unskilled labor means construction and all of its vested and invested stakeholders face an inflection point they can no longer ignore or deny. The choices are clear: either sacrifice margin and a shrinking addressable market, or innovate in such a way as to re-wire the value stream, expand the demand pool, and create a bigger delta between expenses and experienced value. If labor’s not coming back, sustainable profit can only come from innovation, and innovation, increasingly, is the province of bigger companies whose diversification, capital structures, and market leadership allow them the luxury of trying a lot of new ideas to find the ones that will work.

Both the Ply Gem/NCI combination, which promises builders greater velocity, service, and nimbleness in structural building envelope options as a way of gaining cost efficacy and the PGT/Western Windows Systems bond–which together create a powerful standard for contemporary, protective, energy-minded market differentiation map the need for innovation into their go-forward plans. Of course, the mergers also illustrate the investment strategy and tactics of stakeholders who’re playing by the book in terms of managing exposure to latter-stage risks that have pronounced themselves in the residential market of late.

But in the two deals, and in more that we’ll stay tuned for in the coming months leading to the next decade, we see the makings of a fundamentally new pathway to creating vertical construction value, breaking with the inertial efficiency traps that have built up over time into what has been known as a comfort zone.