- A reminder that big U.S.-based publics continue to reign as the most-motivated of acquirers in a hot streak for builder M&A deals, CalAtlantic adds to its “Smile States” footprint as it enters the torrid Seattle market, the No. 15-ranked metro in our Local Leaders line-up of the top 50 new-home building markets.

-

What’s interesting about CalAtlantic’s Oakpointe, LLC beachhead is that it’s a time-released asset acquisition, the mainstay of value being communities due to start opening for sale early next year. Moreover, it suggests an ongoing “favored-nation” relationship with Oakpointe Communities (formerly Yarrow Bay) land acquisition and development, which will continue to function separately from the home building operations unit CalAtlantic acquired.

- Further, the deal suggests that for CalAtlantic, acquisition and integration of companies will continue to play a role in its path of growth, as strategic executives regard M&A to be a “core competence” of the organization in the wake of a highly disciplined and largely successful integration of Ryland Homes and Standard Pacific, a deal that closed in October 2015.

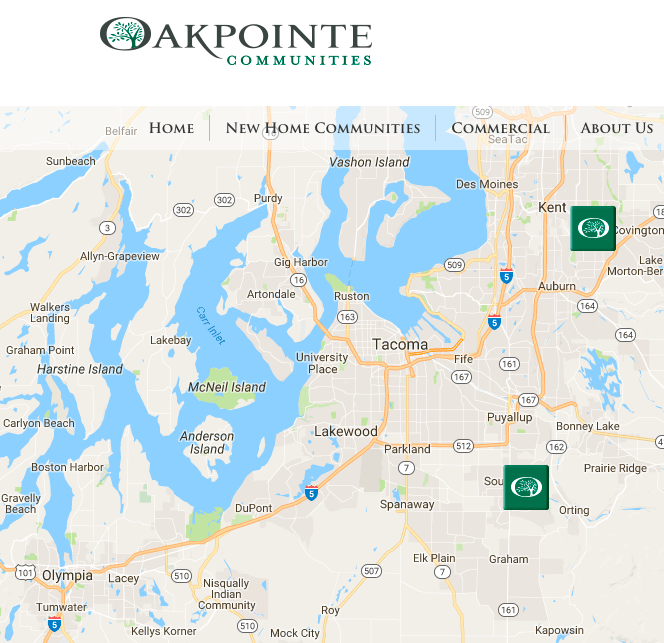

“We’ve been operating in 26 of the nation’s top 50 home building markets, and adding Seattle now makes 27,” CalAtlantic president and ceo Larry Nicholson told BUILDER yesterday, just after the announcement of the deal, which adds 1,750 homesites in 19 future communities to the CalAtlantic lot pipeline. “The majority of the product opportunity with Oakpointe matches well with our move-up and active adult community initiatives. It’s a great team there, who focuses on quality and customer care, and we’re very excited about the opportunity.”

Nicholson and executive VP/coo Pete Skelly noted that the relationship with seller [and founder of Yarrow Bay Group] Brian Ross remains strong, and the expectation is that Ross’s Oakpointe Communities will remain a solid source of lots and development capability well into the future. We’re seeing a spurt in interest among big publics to secure strategic bonds with big-time landholder/developers that give the builder lot supply visibility while the partner gets smoothed out access to capital funding to continue forward-looking land investment.

“We do see mergers and acquisitions as a competency, and as an organization, we continue to look for opportunities in markets, both to establish a presence and to increase our scale and market share with our product lines across a number of growing customer segments,” Skelly said.

Seattle–a hotbed of economic growth thanks to its combination of tech and aerospace sector presence–has been a market big builders have been clamoring to enter or increase their activities over the past several years. Toll Brothers and MDC/Richmond American started the newcomers party by acquiring CamWest for $150 million, and SDC Homes, respectively, in 2011, to kick-start incremental volume growth in an early-recovering market. Since, TRI Pointe took over local powerhouse Quadrant Homes as part of its acquisition of the five Weyerhaeuser home building operators; Sumitomo Forestry took control of Henley USA Group, parent of MainVue Homes, and in the summer of 2014, William Lyon Homes landed one of the biggest Seattle-market catches of all, Polygon NorthWest Company for about $520 million.

Why all the fuss is obvious. Seattle’s solid economic run–fueling high-paid job growth–seems to have headroom to spare, and although land constraints are legendary, builders view the opportunity as irresistible.

Metrostudy Seattle Regional Director Todd Britsch spotlighted three primary take-aways in his recent Q1 2017 analysis on the Seattle market:

As the region grows we are seeing some exit migration out of the greater Puget Sound into outlying counties such as Chelan, Mason, Jefferson and Skagit. We expect continued price increases in 2017 – already prices for new construction in King County are up 21% YoY while Kitsap is up 24% and appears to have run out of affordable housing.

Lot availability is at critically low levels, which will further impact prices: The two highest demand areas in the region (King & Snohomish Counties) have only a 1.5 month supply of lots at Final Plat Approval; there should be close to a 6 month supply to stabilize prices.

Demand outpaces supply, and that’s likely to continue.

Meanwhile, although outlier acquirers such as Sumitomo Forestry, Sekisui House, and Daiwa House will continue to fill in each of their strategic dance cards, given the tax, interest rate, and market urgency drivers supporting their hunt for U.S. private home builders, don’t count out U.S. publics as the most important force in the near-term M&A deal flow for the coming 12 months.