We kept on asking ourselves about Millennial young adults–who’ve just started turning 35–is the reason they’re not stepping up in the housing market a structural issue or a cyclical one?

Evidence abounded to support either claim. On the one hand, if you lean toward cyclicality as the explanation, and wanted to believe that Millennials’ coming of age as adults and their household formation and preferences were merely slowed down by the Great Recession, the data suggested, simply, be patient. You could point to college debt loads and the slow progress of jobs being added to the economy as reasons to surmise that once those young adults reach a wherewithal level similar to prior generations, they’d start buying.

On the other, attitudinal and psychographic measures many observers pointed to suggested a more fundamental shift to explain the 77 million person cohort’s behavior as a new-found, generational aversion to homeownership. This structural disposition, away from the financial, physical, and geographic drag of owning property and toward the more nimble, more urbane, and chicer lifestyle of downtown rental neighborhoods, loomed as a tipping point departure from historical household preference trends, and spawned a “Renter Nation” mentality. Had the American Dream and homeownership somehow decoupled?

Not so fast.

Here, this week, we have a slew of reports that support believers in cyclical theory as the primary context of explanation for a generation whose housing preferences, intentions, and ultimate behaviors may have been delayed by the depth and breadth of the Great Recession and the timing of its clutches, but not necessarily derailed.

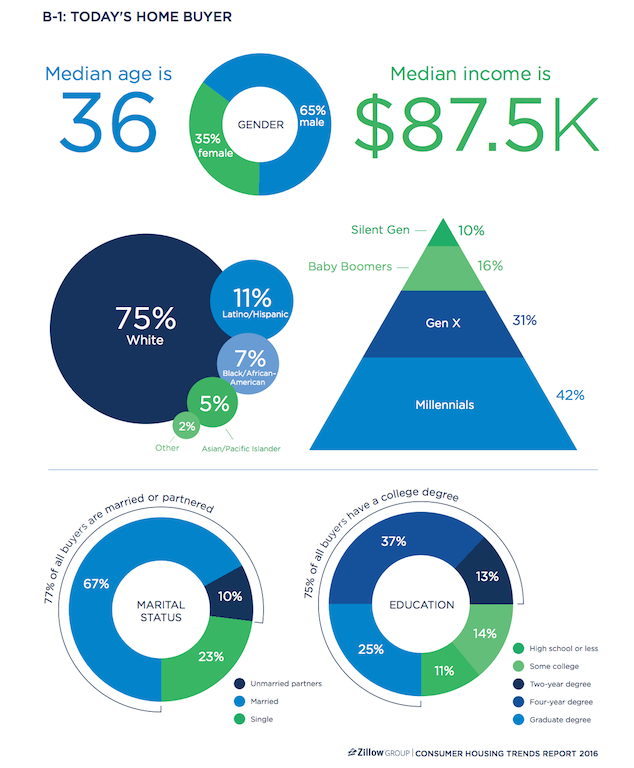

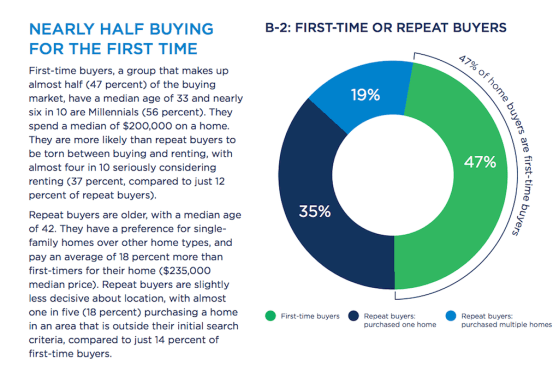

Per Zillow, the median age of home buyers is now 36, and fully half of home buyers is a Millennial. What is more, almost half of Zillow’s sample wants a new home vs. a resale.

The Wall Street Journal’s Laura Kusisto writes here that National Association of Realtors data on current home searches shows that one of each two people mining online real estate sites to find a home to buy is a currently renting (or squatting in parents’ basement) first-timer. Kusisto writes:

[Realtor.com chief economist Jonathan] Smoke said he anticipates the share of first-time buyers could rise to 40% during the peak 2017 selling season. First-time buyers fell to 32% of all purchasers in 2015, the lowest level in three decades, according to the National Association of Realtors. Historically, young buyers have averaged 40% of all home buyers, according to the group.

The latest Existing Home Sales data from the NAR as much as confirms that first-time buyers have already opened the sluice gates, accounting for 34% of home resales in the month of September, vs. 31% in August, and 30% for all of 2015.

Banks seem to be doing their part to support resurgent home buyer interest among qualified would-be first-time home buyers. Here’s a story about how Bank of America is “doubling down” on its partner program with Freddie Mac and the Self Help Venture Fund to offer home purchase mortgages with 3% down payment, and no mortgage insurance. However, two impediments, one psychological and one real could evolve into tailwinds for young adult homeownership prospects in the next six to 12 months.

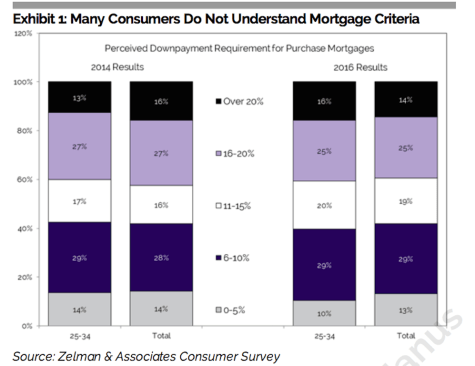

The psychological barrier–spotlighted in a recent installment of The Z Report, a twice-monthly deep-dive analysis series on timely housing finance and trends issues from Zelman & Associates–is that many people who could qualify for mortgage finance still may think they can’t. Register for the Zelman & Associates Z Report for bi-weekly, exclusive, high-level analysis by clicking here. On the issue of actual vs. perceived credit box access, the Z Report analysis notes:

“Overall perception of mortgage credit availability has improved, but of those that do not believe they could qualify, there continues to be a disconnect between actual mortgage credit availability and the perception of mortgage credit availability.”

The other issue is not psychological or perceptual; it’s real. The Government Sponsored Enterprises, Fannie Mae and Freddie Mac, raised their fees, in part to replenish the Federal Housing Administration’s dramatically diminished reserve fund post Great Recession and to throttle back FHA and GSE dominance of for-sale lending.

Policymakers are now considering and more amenable to proposals that would further reduce GSE fees, especially in light of the lender quality and reduced debt risk associated with today’s would-be borrowers, even first-time home buyer borrowers.

The final point for today is this. Millennials and first-time buyers (they’re not the same) did indeed encounter fierce impediments to their entry into the homeownership arena in the past five years. For sure, some of their behavior may be explained by cyclical forces, and possibly, some of it due to inflection-point changes in their need for mobility, flexibility, and financial nimbleness at this point of their work-lives.

The learning for residential developers and home builders to take out of this is not about the broad waves of behavior around homeownership or not. It’s about an entirely new set of decision-support tools and analysis dashboards younger households are working with today to enlighten their pathways vis a vis housing preference, value, and behavior.

One macro-trend that’s so embedded now that we take it for granted is the way that households today behave more and more like little business entities in the economy. The 401k and the convergence of Main Street and Wall Street are one example of that.

It’s the same with households and their housing preference behavior. Today’s young adults are making decisions–even when they’re living in their parents’ basements and/or doubled up four or so in a two-bedroom downtown apartment–as little businesses, not simply as individual consumers.

This is what home builders and developers need to grasp as they build initiatives to meet this rapidly growing unmet need for the now-wave of home buyers reaching their mid-30s.