Here’s some data from Pew Research that may help sharpen estimates of housing demand among today’s young adult.

It’s widely held that student loans, carried by graduates into their early careers, suppress demand–both in household formations, as well as family formation, and homeownership.

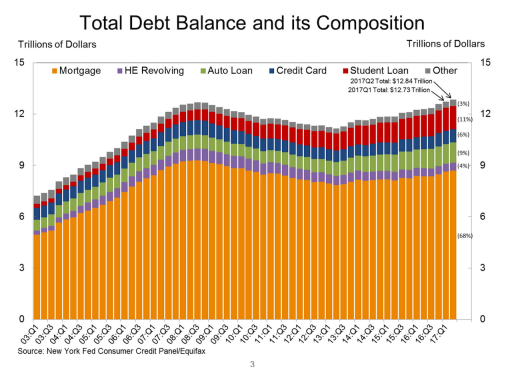

Here’s the brute data that might well support that argument from the New York Federal Reserve. It indicates that student loans comprise 11% of a total U.S. debt balance of $12.84 trillion, which works out to a total of $1.3 trillion in student loans. Pew Research researcher Anthony Cilluffo notes that this level, reached at the end of June of this year, is two-and-a-half times higher than it was in 2007.

College costs, Cilluffo observes, have spiraled, and are a key culprit in the great college debt run-up of the 2000s. So, too, is an equally important fact: more people go to college now than ever. So, looking more precisely at the composition and mechanics of the $1.3 trillion, to see who it hits and who it doesn’t, and by how much, and for how long … all of this is important data to a real understanding of the impact of student loans on demand.

First thing to know is that college debt does not mean the same thing to everybody. Like so many other social and economic trend phenomena, broad-brush assertions can contain more falsehood than truth, and are certainly unhelpful.

So, while the grand total tally of $1.3 trillion is a jaw-dropping figure, it’s critical to understand that, while 16% of all adults have some student loan balances outstanding, they’re concentrated by age group. Two out of five under-30-year-olds carry loan balances, and one out of five 30-to-44-year-olds account for the second largest concentration of student debt holders.

Further, the amount of debt student loan balance holders have yet to pay is widely dispersed across a spectrum, averaging $17,000, but tending to cluster in two opposite regions of the spectrum–$7,000 or less, and $43,000 or more. Cilluffo writes:

Educational attainment helps explain this variation. Among borrowers of all ages with outstanding student loan debt, the median self-reported amount owed among those with less than a bachelor’s degree was $10,000. Bachelor’s degree holders owed a median of $25,000, while those with a postgraduate degree owed a median of $45,000.

Relatively few with student loan debt have six-figure balances. Only 7% of current borrowers have at least $100,000 in outstanding debt, which corresponds to 1% of the adult population. Balances of $100,000 or more are most common among postgraduate degree holders. Of those with a postgraduate degree and outstanding debt, 23% reported owing $100,000 or more.

Three other insights that can help residential developers and builders better understand reality vs. myth in looking at demand among Millennial buyers, and challenges to it:

- Young college graduates with student loans are more likely than those without loans to have a second job and to report struggling financially.

- Young college graduates with student loans are more likely to live in a higher-income family than those without a bachelor’s degree.

- Compared with young adults who don’t have student debt, student loan holders are less upbeat about the value of their degree.

Our take-away in all of this is that what may in bygone days worked as a homogenous “demand universe,”–people of shared demographic, household debt, and income characteristics–now functions as a series of parallel multiverses.

One Millennial demand universe may be the six in 10 college graduates aged 20 to 30 who are debt free, or the four out of five college grads ages 30 to 44 who are also debt free.

A parallel demand universe may be those young adults who’ve secured good jobs but haven’t entirely paid-off their student loans, but who are accelerating payments to shed this burden as quickly as possible.

A third parallel universe might comprise people who may still carry student debt, but who also may make for worthy mortgage borrowers.

And then there are members of each of those universe–who qualify by income, educational attainment, and debt status as some form of “pent-up” demand or other–who simply prefer to rent. They may want the geographical or financial flexibility; they may want freedom from the responsibilities of ownership; they may feel property ownership, a big loan, a long-term commitment to stay put add up to risk.

Many observers and analysts and prognosticators and trend meisters will be correct in their statements about Millennials, and that’s because there are a lot of them. Everybody has a chance to be right. But, not everybody will profit. That’s where strategy, and product line, and operational excellence, and strong sales teams, and a smart data-driven marketing plan come in.

But, even though student debt is racking up new records in total, there’s plenty of demand among 20 to 35-year-olds who are not working to free themselves of its weight.