With a few exceptions, home builders have their work cut out for them trying to ladder their offerings down in price to meet a large and growing market of young adult buyers for whom the moment to buy has arrived.

Many have been busy unveiling “entry-level” product lines, and are looking to bring new communities online that will narrow the $100,000-plus gap between median new-home prices and existing home price tags.

Realistically, that’s a couple of year process, both to get those lots improved and permitted, and get operations and labor in line to deliver that new product profitably.

Few doubt, however, that the there is there as far as demand. It’s just a matter of whether the new baseline price ranges of all this new entry-level targeted product is going to be low enough to compete with resale in the same market or not, especially as rising interest rates start messing with monthly payment calculations in a “when-not-if” future time.

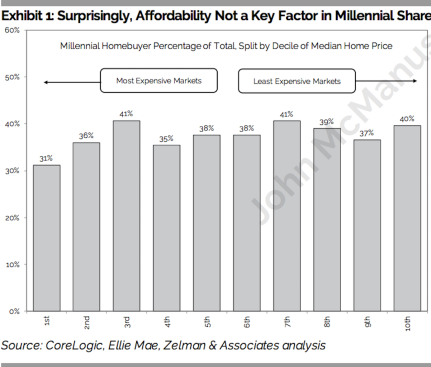

More evidence of traction and real demand among young adult buyers comes clear in the Zelman & Associates’ The Z Report analysis of demographic cuts of Ellie Mae mortgage origination software data, which expose the share of 18 to 37 year-old borrowers in different geographical markets.

For the most recent measurable period, this young-adult segment represents just under 2 of every five mortgage originations in the nation’s largest markets. Zelman analysts note:

A low of 17% in the Sarasota, Florida area contrasts with a high of 50% in the Provo-Orem metropolitan area in Utah. Other notable areas where millennials are dominating the home purchase market include Grand Rapids, MI (49%); Ogden, UT (48%); St. Louis, MO (48%); McCallen, TX (48%); and Des Moines, IA (47%).

Trouble is, as we’ve mentioned for new home builders, squeezing out that big gap between resale home prices, and new home prices. The good news, per Zelman, is that, whether it’s an expensive market or not, young adults tend to represent that close-to 40% share of buyers. (You can sign up for a trial subscription of this valued twice-monthly housing analysis by clicking on The Z Report). This is a sign that moment of demand for homeownership has arrived, probably most among the leading edge mid-30s Millennials, who have waited and now are hurrying-up on family formation front.

We’ve heard about some promising, if unproven, strategic moves builders and developers are at least blueprinting as they try to take out costs to increase the attainability levels of their entry-level offerings.

Certainly some have value-engineered, and streamlined floor-plans, shifted to all-spec, no-options and upgrades inventory, and highly disciplined construction cycle operations to bring completions online as fast as sales happen, all in an effort to pull costs out of the process and monetize the lots predictably.

But recently, some developers are going further.

We’ve picked up word that at a newly-programmed “village 7” at Daybreak, Utah, where Salt Lake Valley stretches out to the Wasatch Range, developers are penciling guidelines for builders that feature fully-finished first-floor living, with unfinished upstairs areas as a tactic to keep costs down. Young family buyers would then improve the second floor areas on their own after a few years of owning, and as their families grow.

And Rancho Mission Viejo in Southern California is considering 800-square foot detached single-family home models as part of its offering in its to be opened newest neighborhood.

All ideas are on the table as new-home community builders keep looking to crack the code to move price points closer to where they know the demand is strong among those mid-30-year-old households who want to own.