Warren Buffett likes the affordable market-rate housing business among the 60-some businesses Berkshire Hathaway lovingly owns. Too, he likes the leadership he’s got in place at Clayton Homes, running one of the biggest affordable market-rate businesses in the nation, if not the biggest.

And, Warren Buffett has a cash problem–too much of it for his own liking–to boot. What’s more, that excess, unproductive, low-yielding cash just swelled suddenly by an extra $29 billion thanks to the effect on corporate tax rates of the new Tax Cuts and Jobs Act signed into law at the end of 2017.

He and fellow Berkshire Hathaway investment guru, vice chairman Charlie Munger are yielding the “day-to-day” empire building work at Berkshire to newly elected directors and vice chairmen Ajit Jain and Greg Abel, as the two senior strategists “focus on investments and capital allocation.”

Buying something big, multi-billions big, in other words.

That was hard to accomplish in the past 12 months, Buffett says in his latest letter to shareholders and the rest of us, largely because dirt cheap borrowing costs made acquisition targets very, very expensive and turned the mergers and acquisitions arena into amateur hour. Buffett’s letter notes:

“Why the purchasing frenzy? In part, it’s because the CEO job self-selects for ‘can-do’ types. If Wall Street analysts or board members urge that brand of CEO to consider possible acquisitions, it’s a bit like telling your ripening teenager to be sure to have a normal sex life.”

Still, Buffett and his Omaha brain trust saw fit to add two noteworthy “bolt-on” acquisitions to the company’s home building business, Clayton Homes.

Clayton Homes acquired two builders of conventional homes during 2017, a move that more than doubled our presence in a field we entered only three years ago. With these additions – Oakwood Homes in Colorado and Harris Doyle in Birmingham – I expect our 2018 site built volume will exceed $1 billion.

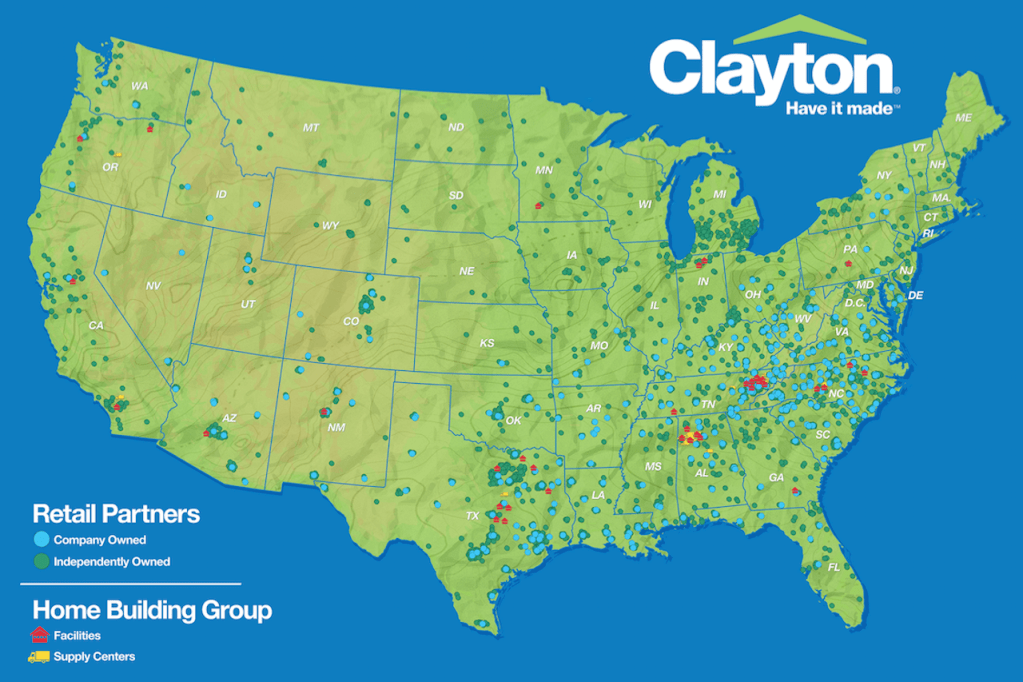

Buffett–while fully transparent about what has happened at his organization, never quite tips his hand about what will come next–notes that Clayton’s core focus is the manufactured homes business, where it commands world domination (in the U.S.) of 49% share of market, with just shy of 20,000 units sold and 27,000 whole-saled through its retailer network.

There are a few wild cards to consider at this particular juncture when it comes to conjecture as to whether Berkshire Hathaway’s gigantic trove of yet-to-be-invested cash may play a role in strategic “bolt-on” acquisitions in the home building space.

From a would-be buyer’s perspective, big motivators come in three primary flavors, and strategic management at Berkshire’s Clayton–headed by Kevin Clayton, Mike Rutherford, Keith Holdbrooks and team–might well leverage all three of them in its further home builder acquisition target interest, primarily as a source for well-placed second- and third-tier market land assets for its well-below-average new home prices.

- Deeper in-market scale

- Exposure to fast-track local economies

- Exposure to barbell customer segments, Millennials and Baby Boomers

Two, the near- and longer-term future of home building’s recovery depends almost certainly on developers’ and builders’ ability to expand the addressable entry-level market to include buyers who could pay no more than $125,000 or, tops, $200,000 to own a home, which is where Clayton’s home building and properties groups are in their zone.

Three, one of Buffett’s avowed principles in looking at acquisition targets is the rule–“We also never factor in, nor to we often find, synergies.” Still, we find there to be a growing case for synergies in Berkshire Hathaway portfolio members whose focus is on where and how people buy homes and live in them.

Shaw Industries, MiTek, Johns Manville, Benjamin Moore & Co., Acme Brick, and Lubrizol, not to mention its exploding Home Services real estate brokerage and insurance businesses all start to add up into quite a housing ecosystem, each organization fueled by an independent strategic impetus, but collectively serving people’s interest in finding and enjoying well-being in their homes.

Four, the offsite-site-build pivot is happening. Before year-end, we predict that the dots between Clayton’s infrastructure of manufacturing facilities and its five site build operators will begin to connect, each business model adopting processes and capabilities of the other. So, it will not be a surprise to imagine more new “nodes” in Clayton’s network of site build operators who have strong operational and cultural baselines that thrive in the lower price bands of new home costs.

From sellers’ standpoint, the promise with Clayton, as would similarly be the case for those who’d consider a strategic sale to one of the three Japan-based companies who are currently trolling for operators, would be that a principle team would stay with the program, help unlock growth, and become part of the Berkshire-Clayton family. This is quite different than many of the strategic acquisitions of the bigger U.S.-based public home builders, who mostly go for the dirt, the trade-base, and the submarket levers of scale.

Motivating some sellers, of course, is the prospect of deep-pocketed believers in autonomy and growth. For some, it’s somewhat the inverse–a graceful exit at an optimized cash-out level.

For Berkshire, the former motivation may yield more viable entity-level pricing, given that principals would be assured that they and their key team members will be part of the grand plan going forward.

When you’re selling seven out of every 10 new homes that cost buyers less than $150,000, you can focus on one of two goals. One goal might be to increase your market share, to 80% or 90%.

The other goal, and the one we see Warren Buffett, Kevin Clayton, and the team lead by Holdbrooks and Rutherford pursuing, is to dramatically expand the total pie of under $150,000 homes and keep at least 70% market share.

So, yes, we see more Clayton Homes mergers and acquisitions activity as likely in the home building space in 2018. Bolt-on or not, deeper and higher-volume penetration of the expanding entry-level marketplace, will allow Clayton to gain even greater buying power in its building materials and products procurement, and flow more of that material through an increasingly sophisticated manufacturing and distribution-to-site infrastructure.